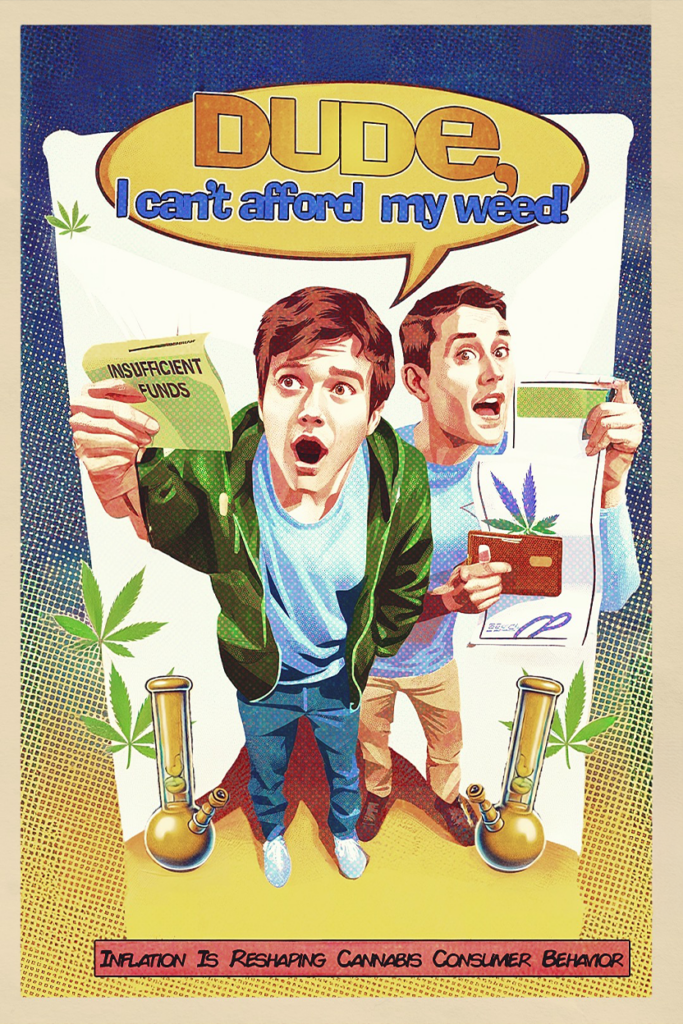

Rising inflation is reshaping cannabis consumer behavior, forcing shifts in spending habits, product choices, and purchasing channels as affordability becomes a growing concern.

The legal cannabis industry has transformed from an underground economy into a multibillion-dollar sector, fueling jobs, generating tax revenue, and driving consumer demand across the United States. However, as inflation continues to erode purchasing power, cannabis consumers are making increasingly strategic decisions about their spending habits.

New spending patterns reveal a stark divide between those who can maintain their usual cannabis consumption and those who are scaling back, seeking lower-cost alternatives, or abandoning the legal market altogether in favor of more affordable unregulated sources. The demand for cannabis remains robust, but inflation is undeniably altering how, where, and why consumers buy it.

A recent NuggMD survey conducted from February 27 to March 2, 2025, found that 66% of cannabis consumers are spending less due to inflation. The findings challenge earlier industry projections that anticipated steady growth in per-customer spending.

The affordability gap is widening, particularly among medical cannabis patients, who are disproportionately affected by price increases. With economic conditions in flux and economists warning of a potential recession on the horizon, the cannabis industry is facing a fundamental question: will it remain an accessible commodity, or is it becoming a luxury product reserved for those with disposable income?

The volatility of the market only exacerbates these concerns, as consumers grapple with fluctuating costs and the uncertainty of what comes next.

Changing Cannabis Spending Habits in an Inflationary Economy

The NuggMD survey highlights the growing concerns surrounding affordability, with both medical and recreational users reporting adjustments in their purchasing habits. Of those surveyed, approximately half identified as medical cannabis patients, a demographic that is particularly vulnerable to economic instability.

This shift mirrors broader trends in healthcare affordability, with a recent Pew survey conducted in February finding that 67% of Americans view the affordability of healthcare as a very big problem, ranking it above issues like inflation and the federal budget deficit.

Even more alarming, roughly one million Americans reported rationing prescribed doses of insulin due to healthcare prices in recent years.

The takeaway is clear—cannabis, particularly for medical users, does not exist in a vacuum.

While rising costs are forcing most consumers to scale back, a notable portion—approximately a third—reports no change in spending, suggesting that price sensitivity is influenced by income levels, consumption habits, and personal priorities. Many are adapting rather than abstaining, turning to budget-friendly brands, purchasing in bulk, or taking advantage of sales and promotions.

Others are seeking alternative sources outside the regulated market, where prices remain lower due to the absence of taxation and compliance costs. In states where home cultivation is legal, there has been a measurable uptick in personal grows as consumers look to offset rising costs with long-term savings. Consumption methods are also evolving, with microdosing and edibles gaining traction as cost-effective options that provide longer-lasting effects per dollar spent.

Taxation and Financial Barriers: The Hidden Costs Behind Higher Prices

One of the most significant contributors to high cannabis prices is IRS Code 280E, a remnant of prohibition-era policy that prevents cannabis businesses from deducting normal operating expenses. As a result, dispensaries and producers are saddled with effective tax rates that can soar as high as 80%, forcing them to pass the financial burden onto consumers.

Industry experts argue that repealing 280E is the most direct path toward lowering cannabis prices, allowing businesses to reinvest in competitive pricing rather than handing over excessive sums in taxes. Until federal reform addresses this issue, however, cannabis consumers will continue to bear the weight of an outdated and punitive system.

Beyond taxation, banking restrictions remain a persistent challenge. Because cannabis remains federally illegal, major financial institutions refuse to process transactions, leaving dispensaries operating as cash-only businesses. This limitation creates a ripple effect: increased security costs to protect cash-heavy operations, limited access to digital payment options, and an inability for consumers to use credit or debit cards as they would at any other retailer.

As inflation forces more Americans to rely on credit to manage expenses, the inability to use those financial tools for cannabis purchases adds another layer of strain. Additionally, dispensaries are unable to offer the types of digital discounts, cashback incentives, or loyalty programs that are standard in other retail sectors. Until banking reform is enacted, the cannabis industry will continue to operate at a financial disadvantage, with consumers paying the price.

Medical Cannabis Patients: The Hardest Hit by Inflation

For medical cannabis users, inflation is more than an economic inconvenience—it is a direct barrier to essential treatment. Unlike traditional pharmaceuticals, medical cannabis is not covered by insurance, forcing patients to absorb the full cost out of pocket. As prices climb, many are rationing their medicine, opting for cheaper strains even when less effective, or in more troubling cases, turning to pharmaceutical opioids as a lower-cost alternative.

The contrast with prescription medication is glaring: when drug prices rise, insurance providers and government programs often intervene with cost-adjustment measures or patient assistance programs. Medical cannabis patients, however, are left without such protections.

The integration of cannabis into state medical insurance programs could significantly reduce this burden, but regulatory and political roadblocks stand in the way. Until systemic reforms address these issues, the divide between cannabis as a recognized medicine and its accessibility for patients who need it most will only continue to grow.

Resilience in the Cannabis Market: Adapting to Economic Pressures

Despite economic turbulence, the cannabis industry has demonstrated remarkable resilience. While consumer spending habits are shifting, overall demand remains stable. In mature cannabis markets like Colorado and Washington, case studies show that economic downturns may influence purchasing behavior but rarely lead to significant sales declines.

This resilience is largely due to the dual role cannabis plays as both a therapeutic product and a lifestyle commodity, existing in a unique space between pharmaceuticals and recreational goods.

Consumers are also getting smarter about their spending. Many are moving away from brand loyalty in favor of prioritizing price-per-potency ratios, seeking value over name recognition. Microdosing has surged in popularity, allowing consumers to extend product longevity without sacrificing therapeutic benefits. Alternative consumption methods, such as tinctures and vaporizers, are gaining traction as cost-efficient alternatives to traditional smoking.

However, while the legal market adjusts, the rise of illicit sales remains a looming challenge. As regulated prices continue to rise, some consumers are migrating to unlicensed sources where lower costs outweigh concerns over product safety and legal consequences. Without meaningful efforts to address taxation and affordability, the growing gap between legal and illicit cannabis threatens to undermine years of regulatory progress.

Navigating Inflation: The Industry’s Next Move

The widening divide between consumers who can afford legal cannabis and those who are being priced out poses a long-term challenge for the industry. If affordability continues to decline, the legal market risks ceding ground to unregulated competitors. Industry leaders and policymakers have clear opportunities to intervene: repealing IRS Code 280E would eliminate tax burdens that drive up prices, expanding financial services access would provide consumers with more flexible payment options, and incorporating medical cannabis into insurance coverage would ensure that patients are not forced to sacrifice treatment due to cost.

Inflation has reshaped cannabis consumer behavior, prompting shifts in spending, product selection, and purchasing channels. While demand remains strong, the growing price sensitivity among consumers will have lasting implications for the market’s future. As long as economic pressures persist, cannabis businesses and lawmakers must confront a crucial question—will cannabis remain an accessible product for all, or will it become yet another casualty of rising costs?

***

GreenPharms is more than just a dispensary. We are a family-owned and operated company that cultivates, processes, and sells high-quality cannabis products in Arizona. Whether you are looking for medical or recreational marijuana, we have something for everyone. From flower, edibles, concentrates, and topicals, to accessories, apparel, and education, we offer a wide range of marijuana strains, products and services to suit your needs and preferences. Our friendly and knowledgeable staff are always ready to assist you and answer any questions you may have. Visit our dispensaries in Mesa and Flagstaff, or shop online and get your order delivered to your door. At GreenPharms, we are cultivating a different kind of care.

Follow us on social media